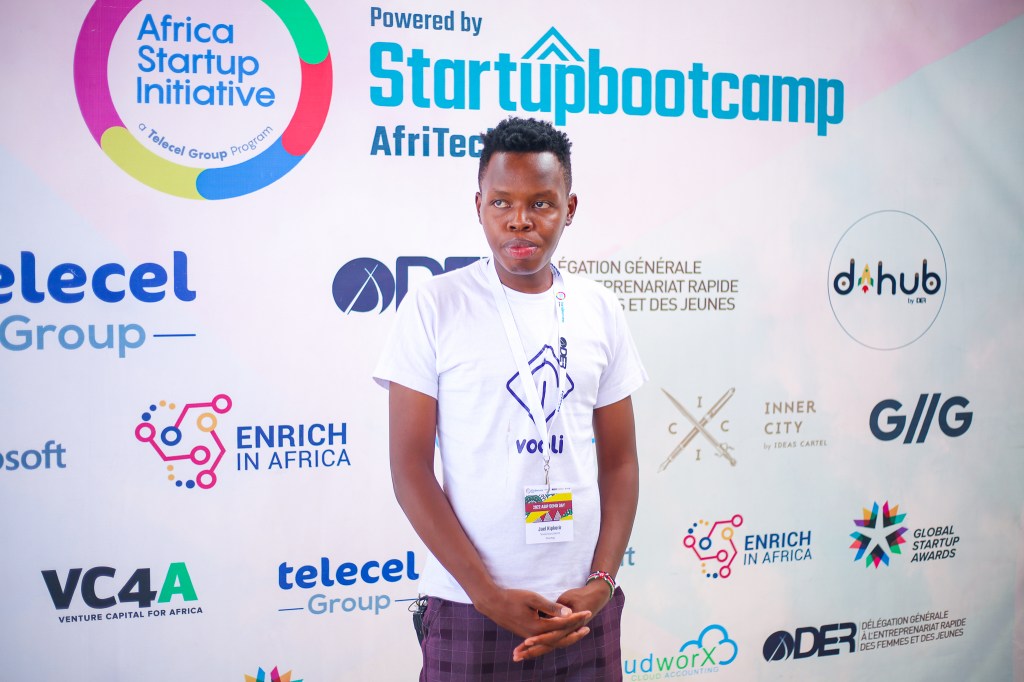

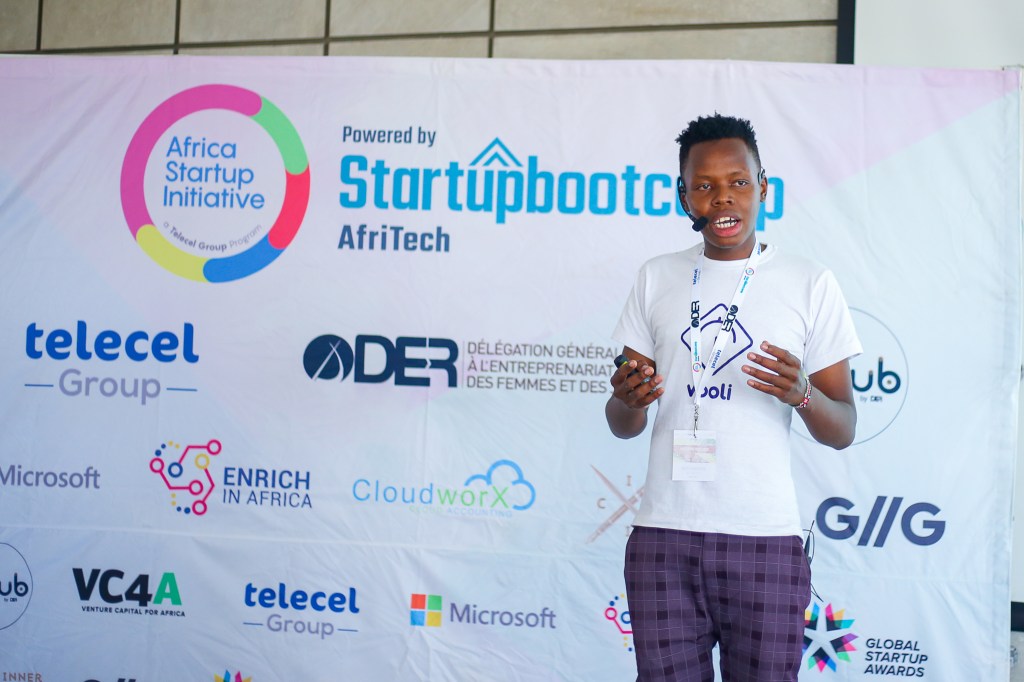

Joel kipkorir’s portfolio.

Hi there,I’m Joel kipkorir, Founder and CEO Vooli

@Vinsurtech.Top 10 Africa @SbcAfritech and Pre-seed funded🌱 by @WorldBank for Financial Inclusion in Insurance.Our Insurance services center around our customers’ most basic issues and openings for a desirable solution: technique, quality, expertise, delivery, efficiency, and sharpness. We bring profound, useful aptitude, and are known for our all encompassing point of view: we catch an incentive crosswise over limits and between the existing solutions of any of our customers. We have demonstrated a multiplier impact from streamlining the aggregate of the parts, not simply the individual pieces.

Vooli offers a wide range of individualized insurance options that are cheaper and easy to

understand.

These are provided seamlessly through an App, website platform and API.

The back-end is powered by cloud processing and Hyperon business rules engine, which

makes the onboarding process 90% faster

And saves our clients as much as 10% off of the l premium quotation.

The Vooli codebase is unique in that it can be easily replicated with new insurance companies.

This eliminates the traditional use of sales agents.

We use a Commission based model with a fee of 10-40% on every premium paid by businesses

and government.

In 2021, we have 53,000 written policies with a TOTAL REVENUE of $188,000.

The insurtech opportunity in Africa is immense.

The total addressable market is $64 Billion and the serviceable addressable market is $10

Billion.

We aim to capture 20% of this.

According to the Big Four Risk Audit and Actuarial companies, 97% of Africans are uninsured,

This is due to the cost of insurance, fraud and lack of access to flexible insurance options.

For example the motor vehicle insurance sector in Kenya has been targeted by cartel rings who

collude to defraud companies.

As a result, the industry has lost an average of $100 Million dollars per annum for the past 10

years

On top of this the insurance process is long, slow and convoluted.

This leads to bottlenecks and frustrations for the policy holders when they initiate the claim

process in the event of a loss

If you would like to join us (or you know someone who would be a good fit) in our Mission to revolutionize and democratize insurance in Africa,We are raising a $300,000 pre-Seed round usi using SAFE